A Digital Journey

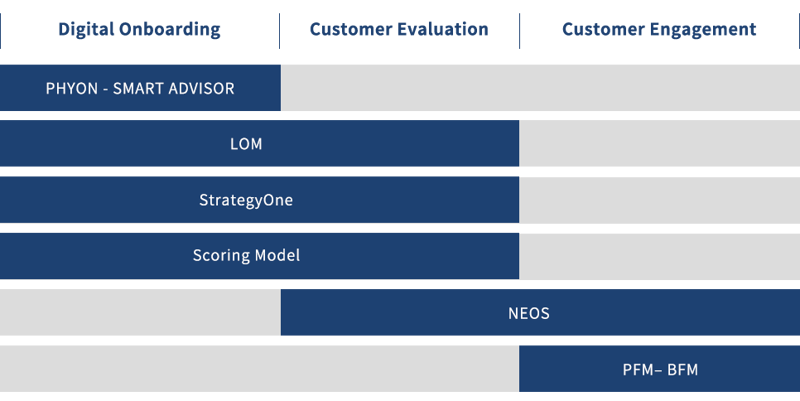

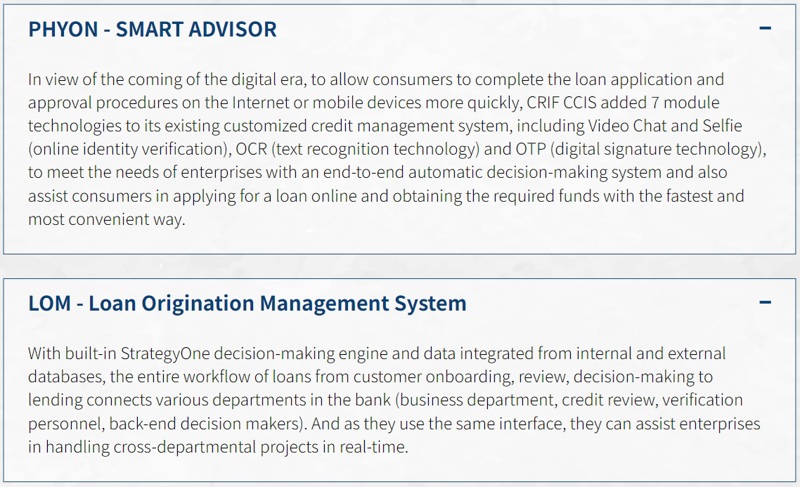

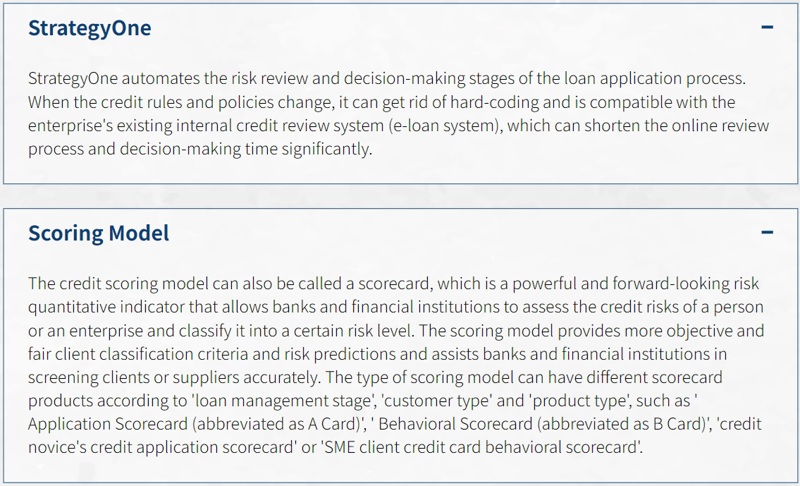

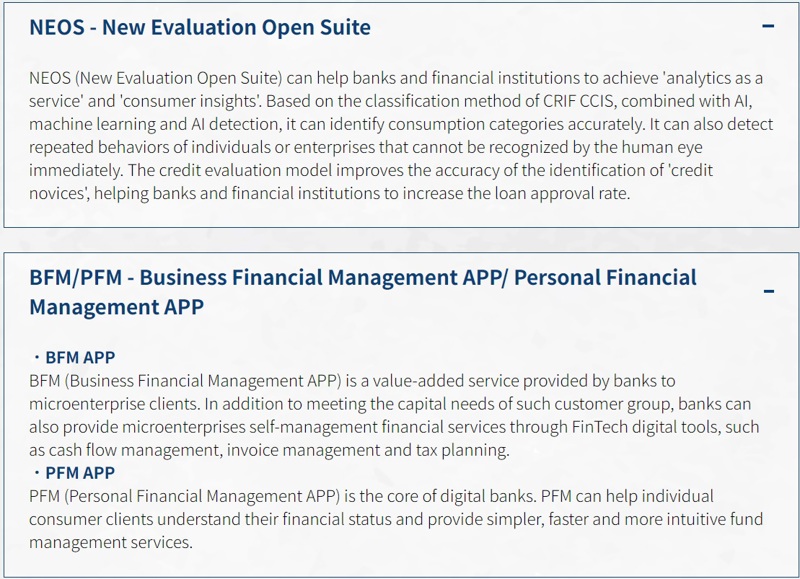

In view of the arrival of the digital era, CRIF CCIS launched the Digital Journey from 'the perspective of a consumer'. It aims to assist bank clients in optimizing existing digital procedures and also assist financial institutions in managing customer relationships based on a 'data-driven' approach.CRIF's Digital Journey is divided into 3 stages: Digital Onboarding, Customer Evaluation and Customer Engagement. These 3 stages correspond to 3 brand-new solutions: “PHYON”, “NEOS” and “BFM APP and PFM APP”.

Found out More

Found out more about how CRIF Fintech solutions can help you effectively manage risks.